|

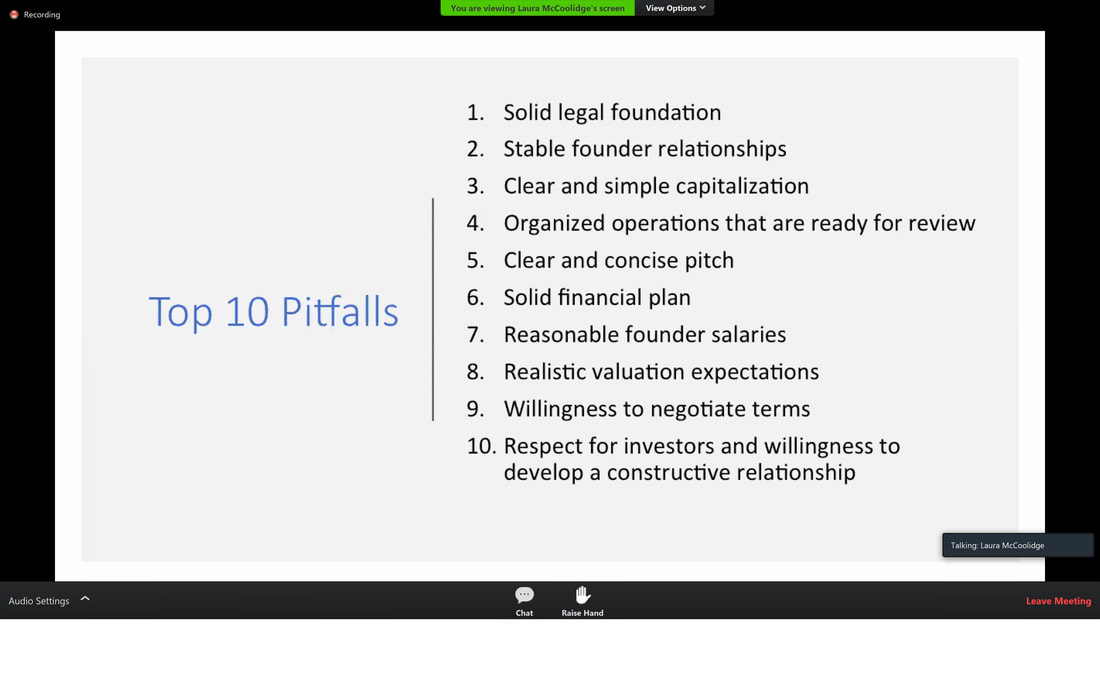

Today the Angel Capital Association (ACA), the largest angel professional development organization in the world, provided an insider perspective that helps you make smart investment decisions and coach startups. They introduced angel investors Bart Dillashaw and Roberta Garven, who shared experiences as investors helping startups through common pitfalls. Most importantly, they shared top 10 list of common pitfalls entrepreneurs and startups need to avoid when raising capital and you need to be aware of as investor. Here is executive recap to help with your understanding and aims:

0 Comments

Leave a Reply. |

AuthorArchives

November 2019

CategoriesVisit Our Other Property:

PianoAndWisdom.com Thank you sponsor:

|

RSS Feed

RSS Feed